UN YOUTH SEYCHELLES

Global Money Week Seychelles 2021

During Global Money Week 2021, the UN Youth Seychelles along with partners reached 198 people through several activities held mostly virtually. The week started with a morning talk show "Bonzour Sesel" to promote GMW and explain the activities for the week.

The first virtual workshop took place on March 23rd and targeted educators form various fields. The session aimed to sensitise participants from several schools and institutions on financial topics such as the importance of budgeting, understanding assets and liabilities as well as investment opportunities available in the country. One financial professional facilitated the session, which was followed by guest speaker, a neuropsychologist and researcher, who gave her insight on the impact of financial stress on individuals. The remainder of the week featured a Virtual Financial Education Tour, consisting of presentations from various institutions: Economics Track, Financial Crimes Track and Business Management Track. The Economics Track Tour comprised three organisations including the Central Bank of Seychelles and the Ministry of Finance, Economic Planning and Trade (MoFEPT).

The second financial education tour’s focus was on the prominent issue of financial crime. This track included SACOS Insurance Group, Mauritius Commercial Bank (MCB) and Financial Intelligence Unit (FIU). The webinar had 45 participants and covered aspects such as money laundering, suspicious transactions, risk-based monitoring amongst many others from the perspectives of these sectors of industry.

The final virtual event was another successful activity featuring Enterprise Seychelles Agency (ESA) and MCB Seychelles who explained various elements of business management, which included the processes of setting up a business. Further insight into the inner operations of a bank were also discussed.

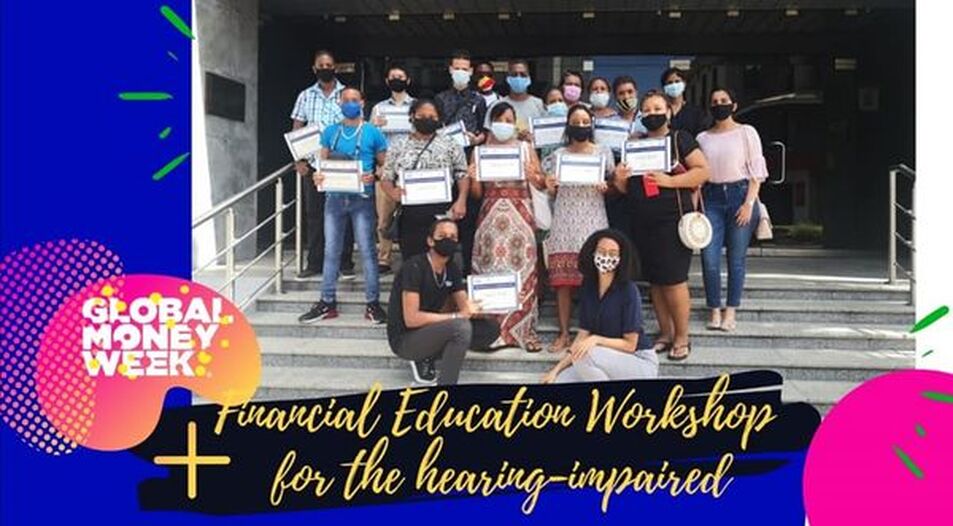

GMW concluded on Saturday, March 27th with a collaborative, in-person financial education workshop for the hearing-impaired involving 19 participants. The event was organised by UNYS and CBS to promote understanding of personal finances and budgeting as well as exploring the role of CBS in Seychelles’ economy and the ability to recognise counterfeit notes ensuring that such campaigns remain inclusive.

The first virtual workshop took place on March 23rd and targeted educators form various fields. The session aimed to sensitise participants from several schools and institutions on financial topics such as the importance of budgeting, understanding assets and liabilities as well as investment opportunities available in the country. One financial professional facilitated the session, which was followed by guest speaker, a neuropsychologist and researcher, who gave her insight on the impact of financial stress on individuals. The remainder of the week featured a Virtual Financial Education Tour, consisting of presentations from various institutions: Economics Track, Financial Crimes Track and Business Management Track. The Economics Track Tour comprised three organisations including the Central Bank of Seychelles and the Ministry of Finance, Economic Planning and Trade (MoFEPT).

The second financial education tour’s focus was on the prominent issue of financial crime. This track included SACOS Insurance Group, Mauritius Commercial Bank (MCB) and Financial Intelligence Unit (FIU). The webinar had 45 participants and covered aspects such as money laundering, suspicious transactions, risk-based monitoring amongst many others from the perspectives of these sectors of industry.

The final virtual event was another successful activity featuring Enterprise Seychelles Agency (ESA) and MCB Seychelles who explained various elements of business management, which included the processes of setting up a business. Further insight into the inner operations of a bank were also discussed.

GMW concluded on Saturday, March 27th with a collaborative, in-person financial education workshop for the hearing-impaired involving 19 participants. The event was organised by UNYS and CBS to promote understanding of personal finances and budgeting as well as exploring the role of CBS in Seychelles’ economy and the ability to recognise counterfeit notes ensuring that such campaigns remain inclusive.

Participating Institutions

- UN Youth Seychelles,

- Central Bank of Seychelles,

- Ministry of Finance, Trade and Economic Planning,

- Sacos Insurance Group,

- Mauritius Commercial Bank,

- Financial Intelligence Unit,

- Enterprise Seychelles Agency,

- Seychelles Broadcasting Corporation,

- Ministry of Education,

- Independent School,

- Association of people with hearing impairment,

- Penlac Seychelles,

- Seychelles Business Studies Academy,

- Anse Boileau Secondary School,

- Bel Ombre Primary School,

- Grand Anse Mahe Primary School,

- La Misère School,

- Perseverance Secondary,

- Au Cap School,

- Anse Royale Secondary,

- La Rosiere Primary School,

- Baie Ste Anne Primary School,

- Pointe Larue Primary School,

- Beau Vallon Primary School,

- Cascade Primary School,

- TJV Matric Higher Secondary School,

- University of Seychelles,

- School of Advance Level Studies,

- International Peace Youth Group,

- ABSA Bank (Seychelles)

Number of Children and Young People Reached Directly |

Number of Adult Reached Directly |

Number of People Reached Indirectly |

Global Launch - March 22 |

|

|

|

|

|

Global Launch - March 22

Organised by the OECD International Network on Financial Education (OECD/INFE), the Global Launch of Global Money Week 2021, held digitally on Monday, 22 March 2021to help kick-start the 9th Edition of the Campaign in over 100 countries worldwide!

SeyLaunch - March 22

The “SeyLaunch” is our very own opening ceremony video which is specifically dedicated to our small island state, Seychelles. This video celebrates all the accomplishments of the previous GMW’s as well as showcasing the importance of this year’s event in a time where our economy is facing many challenges. The live watch parties will be taking place at 5 on our Facebook page and Youtube page.

'Bonzour Sesesel' - March 22

We will be starting off our week of events on the beloved morning talk show "Bonzour Sesel" to promote GMW. In this interview, we will be answering some frequently asked questions regarding GMW as well as providing additional information on this year’s event.

Spotlight Series - What is your financial take on the pandemic - March 23

The Covid-19 pandemic has surely left its impact on economies but let’s not forget about the effect that it had on the everyday individual that had hopes and dreams that this pandemic has washed away. Alongside these events, various ‘spotlight’ posts were released daily on the UN Youth Seychelles social media platforms on the perspective of numerous individuals on what their financial take on the pandemic is.

Virtual Financial Education For Educators - March 23

The first virtual workshop took place on March 23, 2021 and targeted educators from various fields. The session aimed to sensitise participants from several schools and institutions on several financial topics such as the importance of budgeting, understanding assets and liabilities as well as investment opportunities available in the country. Mr Wellington Manjengwa, a Financial Professional facilitated the session which was followed by the guest speaker Ms Sarentha Luther, a neuropsychologist and researcher who gave her insight on the impact of financial stress on individuals. There were 32 participants who attended the session who all expressed positive feedback.

Virtual Financial Education Tour Economic Track- March 24

The remainder of the week featured a Virtual Financial Education Tour which comprised of presentations from various institutions arranged as: Economics Track, Financial Crimes Track and Business Management Track. The Economics Track Tour comprised of three organisations; The Central Bank of Seychellesa and the Ministry of Finance, Economic Planning & Trade (MoFEPT). Overall 49 participants took part in this track and obtained an overview of each institution’s mandate as well as an understanding of the management of different macroeconomic variables. A participant expressed that “For the MoFEPT there were mostly young people presenting, and I could see how high their level of education was. I'm most definitely aiming high in my studies and probably I could be one of the representatives one day.”

.

.

Virtual Financial Education Tour Financial Crimes Track- March 25

The second financial education tour’s focus was on a prominent issue namely Financial crime. This track was included SACOS Insurance Group, Mauritius Commercial Bank (MCB) and Financial Intelligence Unit (FIU). The webinar had 45 participants and covered aspects such as money laundering, suspicious transactions, risk-based monitoring amongst many others from the perspectives of these sectors of industry. A participant explained - “I learned about various types of financial crimes, measures in place to mitigate money laundering and the impacts of money laundering on the banks. For example, through reputational damage the bank could lead to loss of customers. As well as the impact of money laundering on businesses and the economy.”

Virtual Financial Education Tour Business Management Track- March 26

The final virtual event was another successful event featuring Enterprise Seychelles Agency (ESA) and MCB Seychelles which explained various elements of business management, which included the processes of setting up a business. Further insight into the inner operations of a bank which makes it a successful institution was also discussed. “As a business studies student, it showed me that we learn in class is actually applied in the everyday life of businesses and this is quite encouraging.” said one of the participants.

How to explain what is GMW in sign language?

GMW concluded on Saturday 27th with a collaborative, in-person financial education workshop for the hearing-impaired involving 19 participants. The event was organised by UNYS and CBS to promoted understanding of personal finances and budgeting as well as exploring the role of CBS in Seychelles’ economy and the ability to recognise counterfeit notes ensuring that such campaigns remain inclusive. Mrs Anita Gardner from the Association of people with hearing impairment conveyed that “Most participants participated actively in the sessions through the sign language interpreter and the trainers were also able to learn a few signs along the way. All participants learnt a lot and we have positive feedback. Exciting discussions was going on during tea break and after the sessions. They all expressed their wish to be invited to future workshops.”

Participant's Feedback on the Top 3 Lessons the Virtual Tour

Economic Track

Central Bank of Seychelles

- I learned about the functions about the Central Bank, and also about the type of shocks that occur in the economy. I also learned about the different pillars of Seychelles' economy.

- We learned more about the economy , how we trade with the rest of the world..etc. Most importantly how the Covid-19 had a negative impact on the economy and how the central bank had to react to the shock.

- I learnt about the ways in which central bank is engaging itself during this pandemic and got to understand better about the workings of such organisation globally.

- I learnt about the different types of shocks the economy faces in terms of demand and supply, and the monetary policy, and how the Central Banks either tighten or loosen their monetary policy rates.

- Some general info on Central Bank , what is its role as the main branch and how does the banks interact with it.

- Price of commodities are going up month after month, year after year and that we need to find more ways for the Government sector to bring revenue to the country now that the tourism sector and private sector is not doing much. Maybe by bringing back the production of things we used to do and export.

Ministry of Finance, Economic Planning and Trade

- The debt management, the level of debt we are in due to the Covid-19 pandemic.

- What the Ministry of finance does (their work and about the ministry of finance in general)

- I learnt about the vision, structure and functions of the ministry and also I learnt about the types of jobs they have in the ministry.

- That our economy is in huge debt and we can go back to the economic crisis of 2008 if we do not look for alternatives to help our economy.

- The state we are in as a small island state.

- It has shown me that it is an important ministry of our economy. I have learnt that if this ministry fails by not having the appropriate measures for the country thus each branches of the government will collapse.

- The debt department made some interesting revelations on the level of debt of the country which is quite alarming , I believe they are competent and a motivated group of people, they can definitely stir the country to a good debt ratio in the future .

- I learnt about the policies, law and finance related and also how are debt managed in line with the GDP.

Financial Crimes Track

Sacos Insurance Group

- I learned on the measures they take , and ways people usually try to commit crime. Stages of AML and ways people try to that in the lnsurance sector.

- The process of how money is processed into clean money.

- From the presentation by SACOS, I gained knowledge about Financial crime such as money laundering and terrorism financing, different stages of money laundering and terrorism financing as well as the red flags and Customer Due Diligence was deeply explained.

- Examples of red flags

- What is financial crime, terrorism financing, stages of terrorism financing

- I have gained knowledge on how SACOS as an insurance company ensure legitimate financial transactions. This reassures the customers that their investments are secure.

Mauritius Commercial Bank

- How money is important and useful in the economy. How inflation is affecting the Seychelles economy in this period of time due to the COVID-19 pandemic.

- This was a very good and well detailed presentation which also highlighted the stages of AML and current threats to the banks which in this current situation is via Internet. Very well explained, they also highlighted the importance of running CDD which I think should be posted for the general public, often people do not know the purpose of these procedures.

- They can spot any laundering happening and seem to be very alert towards this issue.

- Similar things plus the things the banks tend to look out and CCD

- From the presentation by MCB, I learned about various types of financial crimes, measures in place to mitigate money laundering and the impacts of money laundering on the bank. For example, it is a reputational damage to the bank leading to loss of customers. As well as impacts of money laundering on businesses and the economy.

- The 3 steps of money laundering: Placement, Layering and Integration

Financial Intelligence Unit

- This presentation talked about the role of the FIU. The stages of Money laundering, and the most pertinent issues in the sector. Ways to prevent ourselves from being a victim of such crimes. The Q&A part was the most interesting part of the whole presentation.

- From the presentation by FIU, I acquired knowledge about what is an FIU, and Seychelles FIU. Together with understanding of analysis and receipt of information, along with the DO's and DON'Ts to protect yourselves from financial crimes.

- The FIU provided in-depth detail of money laundering and other financial crimes and also answered a variety of questions pertaining to the matter which is becoming increasingly popular and multi-faceted in a digitalised world

Business Management Track

Enterprise Seychelles Agency

- They have many social objectives, they focus on helping others, how to start up a business what mist you do, where must you go

- MSMEs, how to start a business, importance of knowing your cash flow statement as a business, how to set up a business in Seychelles

- The 10 bookkeeping steps and 3 basic financial statements (balance sheets, cash flow projecting and a profit and loss statement)

- I was intrigued mostly by what they said about cashflow and book keeping- what is it and how it is applied in the running of the business.

- They are an interesting organisation with plenty of social objectives rather than being a profit-making organisation

Mauritius Commercial Bank

- What have they done during the pandemic, how they worked, how they faced the pandemic what they're doing to cope with it, strategies they have and their focus, the 3 sections of their service, one would be their the front line services..

- All respective criteria are essential for you to receive a positive response from your bank when requesting for a loan.

- Vision and strategic focus areas, importance of team work, loans

- Mr Jackson's explanation was very clear. Gave the background of MCB , The background of MCB Seychelles. The goals of the business and the current challenges they are facing . He also highlighted the different services they are providing , such as JUICE and MCB Rupys.

- I learn more information about MCB ,how it is known globally and in Africa. I also learn about MCB objectives and the requirements to get a loan, the different financing facilities available at MCB.

- What MCB considers when giving someone a loan was very informative!!

- We did a small background glanced at the MCB group, and went more in debt with MCB Seychelles were we learned it's Vision, Strategic Focus Areas, core values, the organizational structure...etc. we also looked at the different ways that the MCB tried to cope with the pandemic to make our lives more safe and easier. And a very interesting topic that I personally found interesting was the loan request, which was clearly explained.

- MCB plays an important role in many new business start ups whereby they provide financial aid to such businesses

Proudly powered by Weebly