UN YOUTH SEYCHELLES

Seychelles Global Money Week 2020

Despite the Global Pandemic Seychelles managed to celebrate the Global Money Week for the third time however, all activities were postponed from March 2020 to be held in November 2020 with some activities held throughout the year. This was as a consequence of the imposed restriction of movement to contain the COVID-19.

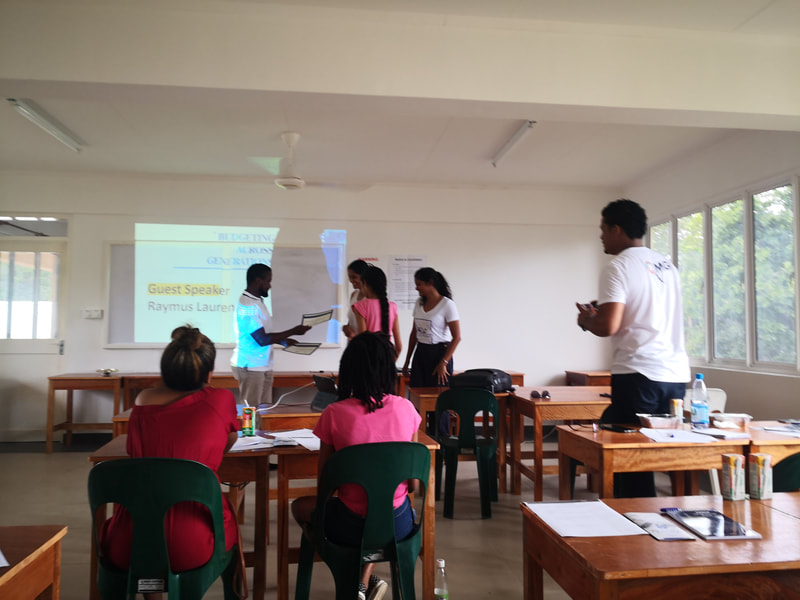

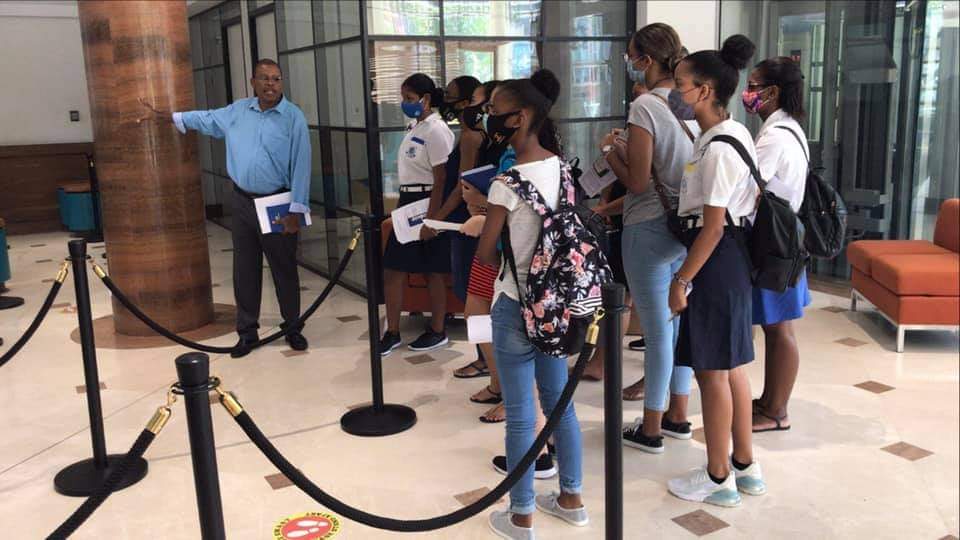

UN Youth Seychelles initiated several activities, and along with its partners, organised visits to various financial institutions. Contrary to previous years there a launching ceremony was not oganised due to the restriction on large gathering. Activities such as Parent-Child Budgeting Workshops themed as ‘Budgeting Across Generation’ was held on Mahe and Praslin. Participants learnt about what money means, goal setting, budgeting, lifestyle inflation, understanding assets and liabilities, short term, medium term and long-term vision. Financial Education Tours was also oganised per tracks namely: Economics, Business Management, Accounting and Financial crimes whereby students learnt about functions of financial institutions and how the financial system works. A Virtual Financial Education Workshop was organised where Participants learnt about what money means, goal setting, budgeting, lifestyle inflation, understanding assets and liabilities, short term, medium term and long-term vision. A ‘Future Cost’ Panel discussion was organised to discuss financial education and the economic landscape with the Contestants of the Miss Seychelles’ Pageant. Lastly, a Budgeting workshop with the Seychelles National Youth Assembly where they learnt about what money means, goal setting, understanding assets and liabilities, economic realities of the country, role of Sustainable Development Goals (SDGs) and how their work related to the same.

UN Youth Seychelles initiated several activities, and along with its partners, organised visits to various financial institutions. Contrary to previous years there a launching ceremony was not oganised due to the restriction on large gathering. Activities such as Parent-Child Budgeting Workshops themed as ‘Budgeting Across Generation’ was held on Mahe and Praslin. Participants learnt about what money means, goal setting, budgeting, lifestyle inflation, understanding assets and liabilities, short term, medium term and long-term vision. Financial Education Tours was also oganised per tracks namely: Economics, Business Management, Accounting and Financial crimes whereby students learnt about functions of financial institutions and how the financial system works. A Virtual Financial Education Workshop was organised where Participants learnt about what money means, goal setting, budgeting, lifestyle inflation, understanding assets and liabilities, short term, medium term and long-term vision. A ‘Future Cost’ Panel discussion was organised to discuss financial education and the economic landscape with the Contestants of the Miss Seychelles’ Pageant. Lastly, a Budgeting workshop with the Seychelles National Youth Assembly where they learnt about what money means, goal setting, understanding assets and liabilities, economic realities of the country, role of Sustainable Development Goals (SDGs) and how their work related to the same.

Participating Institutions

- UN Youth Seychelles

- National Grants Committee

- MCB Seychelles

- BSA Seychelles

- Department of Industry and Entrepreneurship Development

- Enterprise Seychelles Agency

- Shreeji Group

- National Bureau of Statistics

- Central Bank of Seychelles

- Ministry of Finance, Trade Investment and Economic Planning

- Nouvobanq

- Penlac

- Seychelles Revenue Commission

- H. Savy Insurance Company

- Financial Intelligence Unit

- Anti-Corruption Commission Seychelles

- Well of inspiration

- Seychelles Broadcast Corporation

- Telesesel

- Seychelles National Youth Council

- Beauty Empowerment Seychelles

Number of Children Reached |

Participating Institutions |

|

|

|

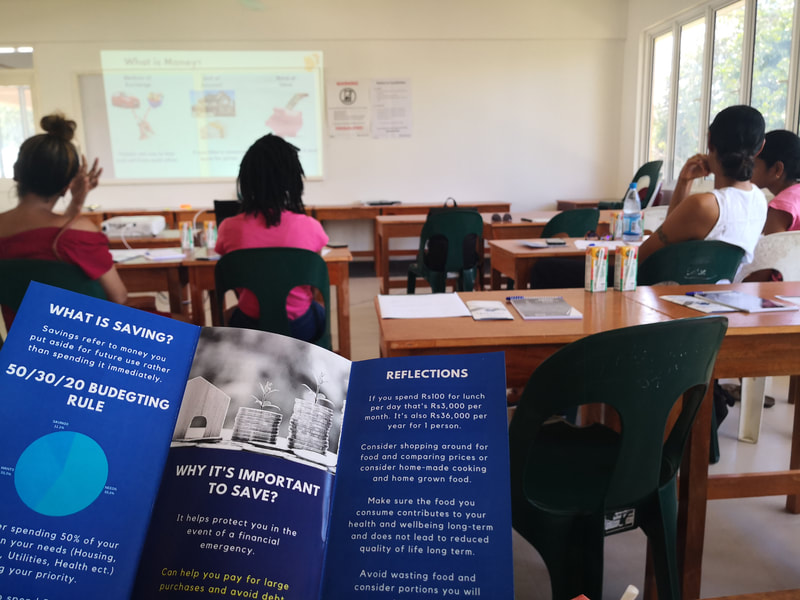

Parent-Child Financial Education Workshop

Participants learnt about what money means, goal setting, budgeting, lifestyle inflation, understanding assets and liabilities, short term, medium term and long term vision.

Financial Education Workshop - Praslin

Virtual Financial Education Workshop

Our first Virtual event proved to be just as fruitful as our usual onsite events. Just to note, we saved around SCR7,000 by switching the event format and spent only around SCR15 for the event platform. We are sharing this with you because similar reflections were discussed in the session. The participants engaged on topics such as 1. What is Money? 2. Philosophy / Beliefs about Money 3. Goal Setting and Goal Getting 4. Assets & Liabilities. 5. Financial Habits 6. Why and How to Budget 7. Big Cheque Syndrome 8. The Pillars of a Budget 9. Compound Interest 10. Using Credit Wisely. It was delightful session and we thank the participants and Mr Wellington for spending your morning with us. We thank all our members for organising this event and the various projects and initiatives they have worked on throughout their time with us especially to mark the occasion of International Volunteers Day!

Some feedbacks from the participants:

Some feedbacks from the participants:

- Thank you so much that was very insightful. Really appreciate your time, This has given me, a solid foundation to plan the new year.

- Very educative and has definitely given me much to think about in terms of spending.

- I found the session to be very informative. I really enjoyed it. I like the fact that it is based on the situation in Seychelles.

- Thank you for this very eye opening session.

- Thank you for the lovely education on finances it was thought provoking;

- I definitely enjoyed the session. very informative and it shows that even in these moments of difficulty we still have opportunity to invest and gain more out of it.

Future Cost Panel Discussion

UN Youth Seychelles in collaboaration with Mauritius Commercial Bank (MCB) organised a future cost panel discussion.

Budgeting workshop with members of the Seychelles National Youth Assembly (SNYA)

UN Youth Seychelles (UNYS) concluded its last Financial Education Workshop today with the excellent participation of the Seychelles National Youth Assembly. The first session encapsulated beliefs about money, importance of goal setting, understanding assets and liabilities, investment opportunities and some key economic concepts. This was followed by a short presentation on Sustainable Development Goals (SDGs), interlinkages between parliament and SDGs, an introduction of UNYS, impact of COVID-19 on youth around the world and their responses against the same.

Financial Education Tour

As savings were identified during the course of implementation, UNYS sought guidance with NGC to host a workshop for youth members of the society. As such, the members of the SNYA were identified who learnt about what money means, goal setting, understanding assets and liabilities, economic realities of the country, role of Sustainable Development Goals (SDGs) and how their work related to the same.

Top 3 Lessons from Institutions visited

Business Management Track

The tour has been very helpful & inspirational. More tours like this should be done. Especially for young people.

Mauritius Commercial Bank (MCB)

- How to start a business and what is needed by a start-up business to get a loan.

- We learnt about how bank loans work and about the basic operations of a bank. We learnt about grants and how the bank helps the economy of a country and also how they help a business grow.

- MCB is presented in 10 countries and has been established for 183 years. Learnt their response to the COVID pandemic via the introduction of E-commerce - Internet payment -Juice app

Department of Industry and Entrepreneurship Development

- That even your own ideas can one day turn into a successful business.

- We learnt about e-commerce and the benefits of digitising a business. We also learnt about the mentorship for entrepreneurship available in the country.

- That they create policies for entrepreneurship encouraging local companies and people to have their own business and willing to take risks.

- Learnt about products that were made in Seychelles

Enterprise Seychelles Agency (ESA)

- It’s the best place to go for business information.

- We learnt about innovation and training

- ESA helps business with starting up their own business by giving out ideas and enforcing the policies that are given by the department above and they give feedback to them to improve the policies

- I learnt that to start my own business I need to go to ESA they can help me get started

Shreeji Group

- How to work as a team and as a family and to Work hard for your future.

- That anything is possible as long as you are willing to put in the work

- That with perseverance and ideas you can achieve anything in the business sector.

- How to manage your business and never give up on your target

- Learnt that no matter how many struggles I may go through, if I really want it I won't give up

Has this tour influenced any of your career goals?

- Yes! It has really influenced me to join the business industry.

- It gave me the knowledge that I needed and confidence

- Yes, it has influenced me on how I would like to see myself in a few years’ time.

- Yes, It made me want to start my own business

Economics Track

The tour has been very fruitful and my hope is that such activities are held more often. When Covid -19 finally dies out, then more students can have the chance to engage in such activities.

National Bureau of Statistics (NBS)

- To start with I just found out about its existence today. The session was very informative and interesting as some light was shed about what exactly they do and how they go about their work.

- I learned about the different departments and what they do. The different surveys they do and how they do it. I also learned about how the other places uses their statistics. Also how they collect data.

- Learnt that they collect data to provide the CBS with and that they do surveys for different kinds of things, and that they are partly in the private sector and partly under the government.

- Learnt that the first stage of economic Planning involves for example going on fieldworks and taking surveys and collecting data. Learned about the different statistics and data such as economic and social statistics as well as the role of NBS.

The tour is really amazing and helpful as it helped us clarify the importance of data and the financial jobs are to the country. It also encouraged us to follow a financial career path as there are many job opportunities

Central Bank of Seychelles

- CBS aside from conducting their own research uses the findings from the National Bureau of Statistics. They play an important role in implementing monetary policies as well as advising the Government.

- I learned about how the economy Covid-19 pandemic affected the Seychelles economy and also how the bank plans to overcome this situation.

- Learnt there are two types of shock : the supply shock that makes production across the economy more difficult and costly and the shock that decreases demand for goods and services temporarily which can cause a shift in consumer spending.

- I learned that they price stability and about the main pillars of the economy which is Tourism, fisheries and financial Services.

I'm more aware of the economy of Seychelles and how the different places I've visited has planned to overcome covid. I’ve learnt so much and I appreciate the opportunity of being able to visit these organisations and hopefully get the opportunity to participate again

Ministry of Finance, Trade, Investment and Economic Planning

- I learned about the importance of doing proper and detailed research before taking out any loans. As a country we must ensure that we are able to pay back our debts on time, and that it is sustainable.

- I learned the different steps I have to follow in order to start my own business and that they give money to help start businesses.

- That there are different types of taxes such as alcohol tax, goods tax, vehicle tax, salary tax. A sector that focuses on the debt of the country and solutions to be able to pay up that debt. Every business / individual needs to pay tax

- I learnt that there are different departments to do different things and that they work with the government. They also forecasts the revenue of the country and others manage the debt of the countries and also help to control tax

- The different departments and how they account information from CBS and NBS . I learnt about core functions of economic planning and about the different roles of employment there and how they make policies based on data. Debts have a huge impact on government and forecasting data for future

- I learned they help businesses and other sectors in times of financial needs

It was very informative, interesting and knowledgeable that will be able to help many more teens to learn more. I definitely recommend that more tracks are done to give chances to other

Nouvobanq

- The difference between retail and corporate services.

- How retail and corporate sector operates- that corporate businesses need more one on one customer interaction as it needs more focus than a retailer that is expecting to wait for a couple of minutes as there are many retailers. Giving good services to both corporate and retail client as corporate clients do not have time, their business needs to be dealt with fast

- That banks have sectors. We learnt how the banks keep their money and how they gain profits.

- I learnt about the different departments at Nouvobanq and about what happens to the money after banking hours. How corporate client services differ from retail client services and what happens to the extra money.

Has this tour influenced any of your career goals?

- It has fueled my interest in the economic field.

- Yes. Helped me learned a lot more on economics of the country the different ways it's being implemented in different organisations and how economics is done and how it's handled as well as opportunities that are available for a future career in the departments.

- The tour definitely influenced my career goals because before I know that i wanted to pursue a career in finance and economics but I was not sure which place or which job. It also helped me understand that the jobs in these departments are important and short-staffed.

- I enjoy the way they work at Central Bank.

- This tour has encouraged me to do economics as a part of A-levels.

- It has encouraged me to seek help from these places if I want to start my own business

Penlac

- Penlac employees are generally young.

- Learned about the manufacturing processes of paint.

- Learned about quality control and how their product differs from their competitors.

- Learned how they create products better suited to the climate of Seychelles.

- Learned of the different processes and raw materials of Penlac.

- Learned of the different career opportunities that Penlac offers.

- How they produce various types and quality of paint.

- Getting to go around in different departments learning about how they each interact with one another.

ABSA

- ABSA promotes more of a digital banking.

- How they deal with customers and complaints.

- The different departments that make up the company.

- The diverse opportunities available at ABSA.

- They are introducing more modern age technology such as apps to connect or interact with the clientèle.

Seychelles Revenue Commission (SRC)

- Learned about the roles and functions of SRC.

- Have a deeper understanding of what SRC stands for, including the necessity of taxation.

- Learned of different taxes and how they work in collaboration with NBS to protect the country’s economy.

- Learned of different departments of SRC such as transportation and trade.

- The penalties of not paying taxes.

- How SRC is not only about taxes.

- Learned of Customs office and what their duties.

- They have a very big role in incomes of goods.

- How they help Seychellois without the money to pay for public schools, infrastructure, health care and social services.

Has this tour influenced any of your career goals?

Yes, gave me a different take on how it would be to work in a bank.

Provided a broader perspective about work and it has added to my future endeavours.

Yes, it has, as it has helped me to understand the topics better.

Yes, it has, it was one of future goals

Yes, because I was looking in the accounting career and I have learned a lot.

Provided a broader perspective about work and it has added to my future endeavours.

Yes, it has, as it has helped me to understand the topics better.

Yes, it has, it was one of future goals

Yes, because I was looking in the accounting career and I have learned a lot.

Financial Crimes Track

More programmes like these should be organised. The youths are definitely in need of such information so that we can also play a role in detecting any financial crimes committed.

H Savy Insurance Company

- Learned how to do proper and ethical insurance practices.

- What’s considered to be a legitimate transaction, and how to identify risky clients.

- Learned about the importance of insurance, fraud cases, and strategies to prevent frauds.

- Learned what the company offers in terms of insurance. What HSI does, in offer for its customers and how they try their best to work alongside their customers to suit their needs, going by the law.

- How they collect necessary information about their sales migration policies, claims, control and mostly about the different levels of insurance.

- H Savy insurance keeps records in light a person is considered to be high risk such as customers which possess criminal records/in a conundrum with the law.

- The financial crimes people commit to obtain money.

- There are strict measures in place in order to detect any foul play. Thorough investigations are conducted before any payments are handed.

- The various policies and procedures put in place at the company to be able to detect or even providing reports to authorities investigating curtain cases.

- How they deal with fraud and money laundering.

I believe it was an interesting tour. I had the chance to visit new places that I never dreamed of, made new friends and learned more about the different sectors visited.

Financial Intelligence unit (FIU)

- Learned the meaning of money laundering and the work of FIU.

- The importance in identifying financial crimes and the processes they go through to disclose such crimes and determining the level of confidential the situation/risk is.

- The types of financial crimes that can happen, such as; money laundering and terrorist financing.

- Establishment FATF and the 4 types of FIU.

- Big co-operations tend to hide from tax so to avoid tax return payments.

- The effects of money laundering and terrorist financing.

- Legal policy and external relations within domestic companies.

- The repercussions of money laundering on a country, tarnishing ones reputation might even end up blacklisted.

- How they interact with other legal institutes to be able to conduct investigations.

- How they interact with international bodies in regard to complying with standards and also communicate information that would be useful to conduct investigations.

It was an amazing experience, learned so many things I never really knew about before, I especially took a great importance to each department and wish to make a difference one day.

CBS

- What is CBS and their main objectives.

- Learned about the history of the bank notes of Seychelles.

- How to identify counterfeit currency and to gained knowledge of the security features; such as signs and symbols that are imputed on bank notes and the importance to be able to identify the features.

- How to identify/distinguish real vs fake money using several methods, such as a UV light.

- What consequences one might face in possession of illegal money.

- Why its important to hand in counterfeit currency to CBS.

Very good and beneficial. Efforts of the organizers deserves appreciation.

Anti-Corruption Commission of Seychelles (ACCS)

- Learned the meaning of corruption and how to identify corruption.

- Ways in which corruption takes place in our daily lives and ways in which I have played a role obviously in promoting corruption in my community.

- How it corruption affects the country and the good personal attributes.

- How they mandate such as investing, detecting and preventing, and how corruption is abuse by the power/private gain.

- The prevention of bribery in corruption. Extortion, nepotism, bribery and fraud is also included.

- Certain behaviours that we should adopt to prevent corruption.

It was extremely interesting and eye opening. It opened up the back door to processes we never thing if which are actually important. The facilitators are really knowledgeable and this was massive moral booster.

Has this tour influenced any of your career goals?

- Yes, I am more interested in the financial sector, more specifically the FIU.

- No. It has shown how to deal with these issues.

- Yes, I’ve learned about the different insurances available for vehicles and life insurance.

- This tour has given me more options in my career choice.

- Yes, and I think it will motivate me to continuously fight for what is right.

- This tour has been a real eye opener. There are a lot of financial crimes going on and I would not mind looking into it in the future.

- Yes, it provided a deeper understanding on the various places we visited. Have a better knowledge of what they actually do, how they operate and the different situations that arises..

- I certainly didn’t have any interest in these businesses or its constituents as I have a passion for science, but the tour definitely did spark an interest in me, especially in FIU.

Proudly powered by Weebly